South Africans with multiple high-interest debts can consolidate them into single loans from banks like Standard Bank, Absa, and Nedbank, saving on interest costs. When choosing a lender, compare interest rates, repayment terms, and fees. Key terms include loan tenure (36-60 months) and APRs (10%-25%). Short-term loans offer lower rates but need consistent cash flow, while long-term options provide flexibility at potentially higher charges. Major South African banks like FNB, Standard Bank, and Absa cater to diverse financial situations with tailored terms. Effective management involves strategic planning, discipline, and timely repayments to improve credit scores.

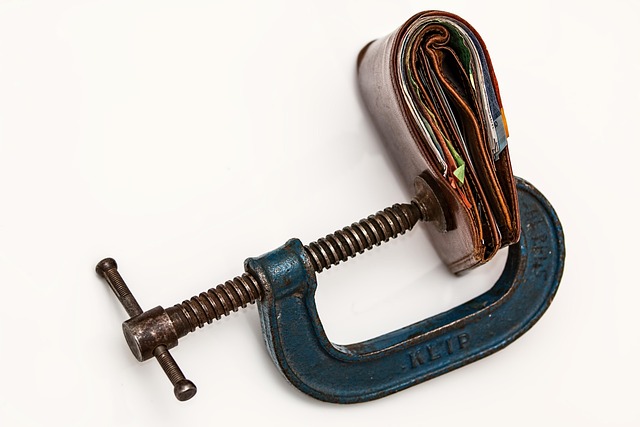

In South Africa, managing multiple debts can be a daunting task. Debt consolidation loans offer a potential solution by combining these debts into a single, more manageable repayment. This article guides you through the intricacies of debt consolidation in South Africa, focusing on key repayment terms and strategies. We explore which banks offer debt consolidation loans, demystifying the process for those seeking financial relief. By understanding interest rates, loan durations, and effective management techniques, borrowers can make informed decisions to regain control over their finances.

- Understanding Debt Consolidation Loans in South Africa

- Which Banks Provide Debt Consolidation Options?

- Key Repayment Terms Explained

- Interest Rates and Fees Associated with Debt Consolidation Loans

- Loan Tenors: Finding the Right Duration for Your Financial Situation

- Strategies to Manage and Repay Your Consolidated Debt Effectively

Understanding Debt Consolidation Loans in South Africa

Debt consolidation loans are a popular solution for South Africans looking to manage multiple debts under one roof. These loans allow individuals to combine various high-interest debt, such as credit cards and personal loans, into a single loan with potentially lower interest rates. This not only simplifies repayment by reducing the number of payments but can also save money on interest costs over time.

In South Africa, several banks offer debt consolidation loans, each with its own terms and conditions. When considering this option, it’s crucial to research which banks provide such loans, compare their interest rates, repayment periods, and any associated fees. Popular choices among local banks include Standard Bank, Absa, and Nedbank, each catering to different customer segments with tailored consolidation loan packages.

Which Banks Provide Debt Consolidation Options?

In South Africa, several banks offer debt consolidation loans as a financial solution for individuals struggling with multiple debts. Among them, First National Bank (FNB) stands out for its comprehensive range of loan products, including debt consolidation options tailored to meet diverse customer needs. Absa Group also provides similar services through its various banking platforms, enabling clients to consolidate their debts into single, manageable payments.

Standard Bank is another prominent financial institution that offers debt consolidation loans as part of its personal financing portfolio. These banks ensure that the process is streamlined and accessible, helping borrowers simplify their financial obligations and improve their overall cash flow management. When considering which bank to approach for a debt consolidation loan, it’s essential to compare interest rates, repayment terms, and any associated fees to make an informed decision based on your specific circumstances.

Key Repayment Terms Explained

When considering debt consolidation loans in South Africa, understanding the repayment terms is crucial for making an informed decision. These loans are designed to simplify your debt management by combining multiple debts into one with a single monthly payment. The key repayment term to focus on is the loan tenure, which refers to the period over which you’ll be repaying the loan, usually in months or years. Which banks offer debt consolidation loans typically provide options ranging from 36 to 60 months, allowing borrowers to choose a duration that aligns with their financial capabilities.

Another vital term is the interest rate, which determines the cost of borrowing. Fixed-rate loans offer predictability by keeping the interest consistent throughout the tenure, while variable rates can fluctuate based on market conditions. Some banks may also charge an administration fee or require regular minimum payments to avoid penalties. It’s essential to compare these terms across different lenders, including which banks offer debt consolidation loans, to find the most favorable conditions tailored to your financial situation.

Interest Rates and Fees Associated with Debt Consolidation Loans

When considering a debt consolidation loan in South Africa, understanding the interest rates and associated fees is paramount. These loans aim to simplify multiple debt obligations by combining them into one manageable repayment structure. However, it’s important to note that unlike personal loans or credit cards, which often come with fixed or variable interest rates, debt consolidation loans typically carry varying APRs (Annual Percentage Rates) depending on the lender and your creditworthiness.

Which banks offer debt consolidation loans in South Africa? Major financial institutions like Absa Bank, Standard Bank, First National Bank (FNB), and Nedbank provide these services. Each bank has its own set of terms and conditions, with interest rates ranging from around 10% to 25%. In addition to the interest, lenders may charge various fees such as application fees, assessment fees, or early repayment penalties. It’s advisable to compare offers from multiple banks to find the most suitable debt consolidation loan that aligns with your financial situation and budget.

Loan Tenors: Finding the Right Duration for Your Financial Situation

When considering debt consolidation loans in South Africa, understanding loan tenors is a crucial step. Loan tenor refers to the duration over which you’ll be repaying your debt, and choosing the right one depends on your financial situation. Short-term loans typically range from 12 to 24 months, offering lower interest rates but requiring consistent cash flow. On the other hand, long-term loans can span up to 60 months or more, providing more flexibility in repayments but potentially incurring higher interest charges.

Which Banks Offer Debt Consolidation Loans plays a significant role in your decision. South African banks like First National Bank (FNB), Standard Bank, and Absa offer debt consolidation loans with varying tenor options. Researching these institutions allows you to compare rates, terms, and conditions. Remember, the ideal loan tenor balances your need for financial relief against the long-term goal of debt eradication.

Strategies to Manage and Repay Your Consolidated Debt Effectively

Managing and repaying your consolidated debt effectively is a strategic process that requires discipline and understanding. Firstly, evaluate your financial situation by listing all your debts and their respective interest rates. This will help identify areas for improvement and allow you to prioritize repayment based on savings in interest costs. Many banks in South Africa offer debt consolidation loans with flexible terms, so shop around to find the best deal that suits your needs.

Once you’ve chosen a lender, create a structured repayment plan. Set realistic goals by dividing your total debt into manageable monthly installments. Consider automating these payments to avoid missing deadlines and ensure consistent progress. Remember, timely repayments not only help you stay on track but also positively impact your credit score over time.