South Africans can alleviate multiple high-interest loan burdens through debt consolidation loans offered by major banks such as First National Bank (FNB), Standard Bank, and Absa. These institutions provide competitive rates and flexible terms but have varying eligibility criteria. Researching and comparing bank offerings is essential to secure the best deal for individual financial situations. The process involves assessing your financial standing, identifying participating banks, evaluating loan terms, preparing an application, and reviewing the agreement thoroughly before signing.

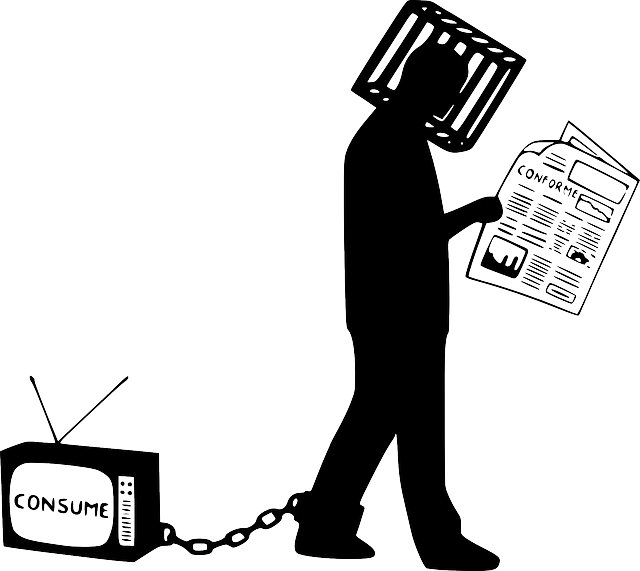

South Africans facing debt can find hope in debt consolidation loans, a strategic approach to financial stability. This comprehensive guide explores how these loans can simplify repayment and reduce interest costs. We delve into the process, highlighting key steps to securing a loan. Furthermore, we name the South African banks that offer this service, empowering individuals to make informed decisions. By understanding debt consolidation, you can take control of your finances and step towards a brighter financial future.

- Understanding Debt Consolidation Loans: A Comprehensive Guide for South Africans

- Which Banks in South Africa Offer Debt Consolidation Loans?

- Navigating the Process: How to Secure a Debt Consolidation Loan and Achieve Financial Stability

Understanding Debt Consolidation Loans: A Comprehensive Guide for South Africans

Debt consolidation loans offer a strategic way for South Africans to manage their debt by combining multiple high-interest loans into one single loan with a lower interest rate. This simplifies repayment, saves money on interest payments, and can help individuals get back on track with their financial goals. When considering a debt consolidation loan, it’s crucial to understand the options available, including which banks offer these services.

Many reputable South African banks provide debt consolidation loans as part of their financial products. These include major institutions like First National Bank (FNB), Standard Bank, and Absa Bank. Each bank has its own set of criteria for eligibility and interest rates, so it’s essential to research and compare offers to find the best fit based on your financial situation.

Which Banks in South Africa Offer Debt Consolidation Loans?

In South Africa, several banks offer debt consolidation loans as a path to financial stability for their customers. Major banks like Standard Bank, Absa (formerly known as First National Bank), and Nedbank provide these facilities, catering to diverse economic needs. These institutions understand the burden that multiple debts can place on individuals and families, hence their commitment to offering consolidated loan options with competitive interest rates and flexible repayment terms.

When considering a debt consolidation loan from these banks, South Africans should explore various products to find one tailored to their financial situation. Each bank has its own eligibility criteria, interest rate structures, and repayment plans, making it crucial for borrowers to compare offers before making a decision. This approach ensures they secure the best terms for their specific circumstances.

Navigating the Process: How to Secure a Debt Consolidation Loan and Achieve Financial Stability

Navigating the process of securing a debt consolidation loan involves several key steps. Firstly, assess your current financial situation and determine which banks offer debt consolidation loans in South Africa. Research various lenders to find the one that best suits your needs, considering interest rates, repayment terms, and any associated fees.

Once you’ve chosen a lender, prepare your application by gathering necessary documents such as proof of identity, income statements, and details of existing debts. Submit your application, and if approved, review the loan agreement carefully before signing. This ensures you understand the terms and conditions, including repayment schedules and potential penalties.