South Africans struggling with debt can improve their financial situation by considering consolidation loans from major banks like Absa, Standard Bank, First National Bank (FNB), and Nedbank. To make an informed choice, borrowers should compare interest rates, repayment periods, and fees, selecting a bank that aligns with their needs. A solid credit history is essential for approval, and due diligence in researching and applying for consolidation loans can lead to reduced debt and financial stability.

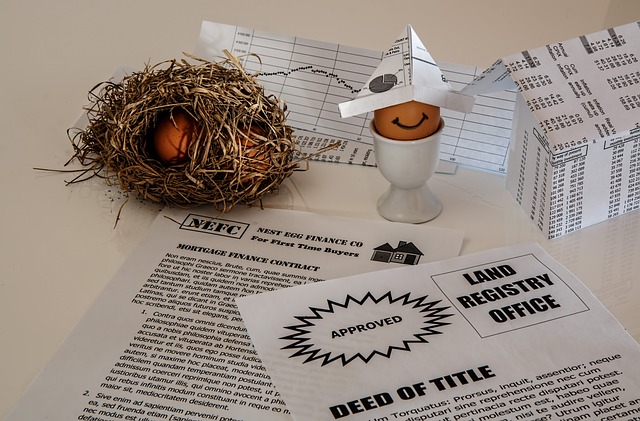

In the quest for financial stability, many South Africans are turning to debt consolidation loans as a solution. This comprehensive guide explores how these loans can simplify repayment and reduce stress by combining multiple debts into one manageable loan. We delve into the benefits, including improved credit scores and lower interest rates. Furthermore, we provide an insightful look at which banks in South Africa offer debt consolidation loans, guiding you through the application process with practical tips for securing the best deal.

- Understanding Debt Consolidation Loans: A Comprehensive Guide for South Africans

- The Benefits of Debt Consolidation: How It Can Improve Your Financial Situation

- Which Banks in South Africa Offer Debt Consolidation Loans?

- Navigating the Application Process: Tips for Securing a Debt Consolidation Loan

Understanding Debt Consolidation Loans: A Comprehensive Guide for South Africans

Debt consolidation loans are a popular financial tool for South Africans looking to simplify their debt burden and gain control over their finances. These loans allow individuals to combine multiple debts, such as credit cards, personal loans, and store cards, into a single repayment with a lower interest rate. By doing so, borrowers can save money on interest payments and make their debt management more manageable.

When considering which banks offer debt consolidation loans, it’s essential to compare various options. Major South African banks like Absa, Standard Bank, and First National Bank (FNB) provide these loans with competitive terms. Each bank has its own eligibility criteria and loan conditions, so borrowers should research and choose the one that best suits their needs. Factors to consider include interest rates, repayment periods, and any additional fees associated with the loan.

The Benefits of Debt Consolidation: How It Can Improve Your Financial Situation

Debt consolidation offers South Africans a powerful tool to gain control over their finances and work towards stability. By bundling multiple debts into one loan with a lower interest rate, individuals can simplify their repayment process and potentially reduce overall debt. This strategy is particularly beneficial for those burdened by high-interest credit card debts or various loans from different banks. With a consolidation loan, you make one monthly payment at a reduced rate, making it easier to manage your budget.

When considering which banks offer debt consolidation loans, South Africans have several reputable options. Many local banks provide tailored consolidation plans, allowing borrowers to choose the term and repayment structure that suits their needs. This process can significantly improve cash flow, reduce stress, and even free up funds for other important expenses or savings goals. It’s a step towards financial wellness, enabling individuals to regain control of their money and plan for a secure future.

Which Banks in South Africa Offer Debt Consolidation Loans?

In South Africa, several banks offer debt consolidation loans as a path to financial stability for their clients. Among the prominent institutions providing this service are Absa Bank and Standard Bank. These banks understand the challenges of managing multiple debts and offer tailored solutions to help individuals consolidate their debts into single, more manageable payments.

Other notable players include First National Bank (FNB) and Nedbank. Each bank has its own set of criteria and loan terms, catering to different financial needs. When considering a debt consolidation loan, it’s crucial to compare offers from various banks to find the most suitable option based on interest rates, repayment periods, and additional benefits like financial counseling services.

Navigating the Application Process: Tips for Securing a Debt Consolidation Loan

Navigating the application process for a debt consolidation loan can seem daunting, but with the right approach, South Africans can secure financial stability. Start by researching which banks offer debt consolidation loans and compare their terms and conditions. Choose a bank that aligns with your financial needs and offers competitive interest rates. Next, assess your credit history and ensure it’s in good standing, as this significantly influences loan approval. Gather all necessary documents, such as proof of income and identity, to streamline the application process.

Consider reaching out to a financial advisor for guidance. They can provide valuable insights into the best loan options available and help you understand the repayment terms. Additionally, be mindful of hidden fees and ensure transparency from the lender. A clear understanding of the loan agreement is essential to avoid surprises down the line. With careful planning and due diligence, debt consolidation loans can offer a much-needed respite from multiple debt obligations.