Entrepreneurs in South Africa can achieve financial freedom through debt consolidation loans offered by major banks like Absa Bank, Standard Bank, and First National Bank (FNB). These loans merge multiple debts into one with lower interest rates, simplifying repayment. To find the best option, compare interest rates, terms, and fees across these institutions based on individual financial needs and credit profiles. Successful debt consolidation requires careful planning, including document preparation, maintaining a good credit score, adhering to repayment schedules, and regularly assessing finances.

Entrepreneurs in South Africa often face financial challenges, with debt consolidation being a common solution. This comprehensive guide explores how debt consolidation loans can unlock financial freedom for business owners. We delve into the process, benefits, and risks, providing insights on understanding and navigating this powerful financial tool. Discover which banks in South Africa offer debt consolidation loan solutions, learn about application procedures, and gain expert tips for effective management. Take control of your finances and make informed decisions with this essential resource.

- Understanding Debt Consolidation Loans: Unlocking Financial Freedom for Entrepreneurs

- Which Banks in South Africa Provide Debt Consolidation Loan Solutions?

- Navigating the Process: Applying for and Managing Your Debt Consolidation Loan Effectively

Understanding Debt Consolidation Loans: Unlocking Financial Freedom for Entrepreneurs

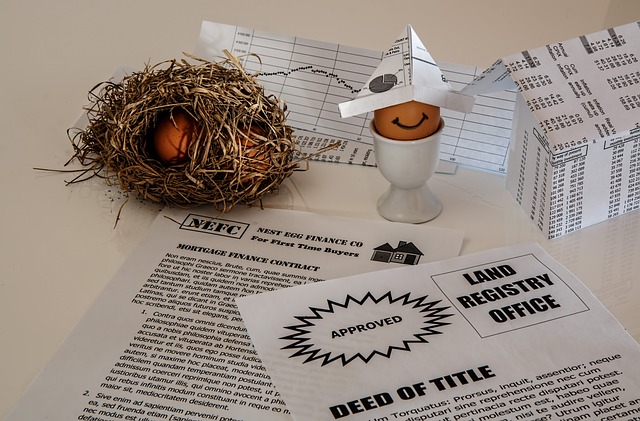

Debt consolidation loans offer a strategic path to financial freedom for South African entrepreneurs grappling with multiple debts. These loans enable business owners to combine various debt obligations into a single, more manageable loan with a lower interest rate. By doing so, they simplify repayment processes and alleviate the burden of managing multiple lenders.

Several banks in South Africa offer debt consolidation loans, providing entrepreneurs with options to choose from. When considering which bank to approach, it’s crucial to compare interest rates, repayment terms, and any associated fees. Major financial institutions like Absa Bank, Standard Bank, and First National Bank (FNB) are known for their comprehensive loan offerings, including debt consolidation options. Entrepreneurs should thoroughly research these banks’ terms and conditions to find the best-suited solution for their unique financial circumstances.

Which Banks in South Africa Provide Debt Consolidation Loan Solutions?

In South Africa, several banks offer debt consolidation loan solutions tailored for entrepreneurs looking to streamline their financial obligations. Among the prominent institutions providing these services are First National Bank (FNB), Standard Bank, and Absa Bank. Each bank has its own set of criteria and interest rates, but they all share a common goal: to help business owners merge multiple debts into one manageable loan.

First National Bank, for instance, offers debt consolidation loans with flexible repayment periods, allowing entrepreneurs to spread out their payments over time. Standard Bank provides similar facilities, focusing on competitive interest rates and customized repayment plans. Absa Bank also participates in this space, ensuring that South African entrepreneurs have access to the financial support needed to consolidate their debts and grow their businesses.

Navigating the Process: Applying for and Managing Your Debt Consolidation Loan Effectively

Navigating the process of applying for and managing a debt consolidation loan involves several steps that require careful consideration. Firstly, identify which banks offer debt consolidation loans in South Africa, as this will depend on your specific financial needs and credit profile. Popular options include Absa Bank, Standard Bank, and First National Bank (FNB), among others. Each bank has its own application process and terms, so compare offerings to find the best fit for consolidating your debts.

Once you’ve chosen a lender, prepare your application by gathering necessary documents such as proof of identity, income statements, and details of existing debts. Ensure your credit score is in good standing, as this will impact interest rates and loan approval. After approval, manage your loan responsibly by adhering to the repayment schedule and keeping track of balances. Regularly review your financial situation and consider additional debt management strategies for long-term financial health.